-

Full details→

![Go See: Collect 2026]()

Professional Development Go See: Collect 2026

Craft Scotland is offering a small number of fully-funded bursaries to provide Scotland-based craft professionals with the opportunity to visit Collect Art Fair 2026.

Closing date: 16 Jan 2026

-

Full details→

![Collections Curator at Hospitalfield]()

Residencies & Jobs Collections Curator at Hospitalfield

Hospitalfield are seeking experienced applicants for the new role of Collections Curator.

Closing date: 19 Dec 2025

-

Full details→

![Open Call: Coburg Kiln II]()

Exhibit & Sell Open Call: Coburg Kiln II

Coburg Art House & Gallery are excited to announce an open call for upcoming exhibition Coburg Kiln II, celebrating the breadth, innovation, and material richness of contemporary ceramics.

Closing date: 17 Dec 2025

-

Full details→

![Spirit of Spark]()

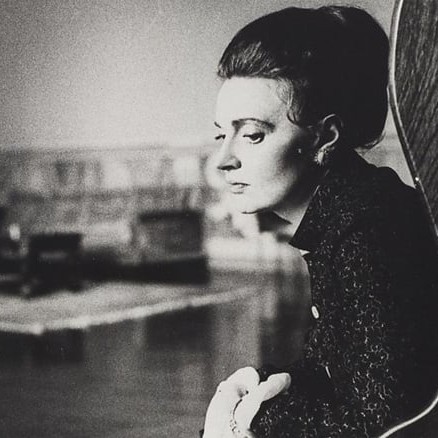

Commissions Spirit of Spark

Public Art Commission: Celebrating the life and work of Dame Muriel Spark.

Closing date: 11 Jan 2026

-

Full details→

![World Hope Forum Scotland: Reshaping Traditions, Retelling Stories]()

Conferences & Maker Training World Hope Forum Scotland: Reshaping Traditions, Retelling Stories

This edition of the World Hope Forum brings together established artists, curators and emerging creatives whose practices honour lineage while imagining fresh possibilities.

Closing date: 14 Dec 2025

-

Full details→

![Interweaving Threads Residency: Scotland and Norway through Dress]()

Residencies & Jobs Interweaving Threads Residency: Scotland and Norway through Dress

Call for applications for the Interweaving Threads Residency, a new programme for textile artists, designers, and makers based in Scotland and Norway.

Closing date: 5 Jan 2026

-

Full details→

![The Bridge Awards Residencies 2026]()

Residencies & Jobs The Bridge Awards Residencies 2026

Funded residencies for artists based in Scotland whose careers have been impacted by a breast cancer diagnosis.

Closing date: 12 Jan 2026

-

Full details→

![Dream Plan Do Festival and VIP Club]()

Professional Development Dream Plan Do Festival and VIP Club

Closing date: 13 Jan 2026

-

Full details→

![The Theo Moorman Trust for Weavers]()

Funding The Theo Moorman Trust for Weavers

The Theo Moorman Trust have released the Weavers Award which is open to weavers living and working in the UK: Grants of between £500 – £5,000

Closing date: 5 Feb 2026

-

Full details→

![Residency Space on the Isle of Skye]()

Residencies & Jobs Residency Space on the Isle of Skye

Wasps invite visual artists, makers, designers, writers and performers to apply to stay at The Admiral’s House in Skye

Closing date: 30 Mar 2026

-

Full details→

![Visual Artist and Craft Maker Awards]()

Funding Visual Artist and Craft Maker Awards

Are you looking for funding to support your creative and professional development? VACMA is designed to help you grow and develop your creative practice with fixed bursaries of £500 or…

Closing date: 3 Feb 2026

-

Full details→

![Workshop Bench Space Available in Edinburgh – Short-Term Hire]()

Studio & Workshop Spaces Workshop Bench Space Available in Edinburgh – Short-Term Hire

Flexible Workshop Space for Woodworking – Available Weekly or Monthly (Edinburgh)

Closing date: 10 Jan 2026

Craft Community

Stay up-to-date with Maker Opportunities and Craft Scotland news through our newsletters. Subscribe